Download the PDF here

How to read this guide

This guide introduces milestones on the path to mobile network data access. While it is aimed at stakeholders in national statistical systems and across national governments in general, the lessons should resonate with others seeking to take this route. The steps in this guide are written in the order in which they should be taken, and some readers who have already embarked on this journey may find they have completed some of these steps.

This roadmap is meant to be followed in steps, and readers may start, stop, and return to points on the path at any point.

The path to mobile network data access has three milestones:

- Evaluating the opportunity – setting clear goals for the desired impact of data innovation.

- Engaging with stakeholders – getting critical stakeholders to support your cause.

- Executing collaboration agreements – signing a written agreement among partners.

The steps to reach each milestone are laid out in the corresponding chapters, along with the following information:

🌐 Global benchmarks or success stories of others with a relevant story or example.

❗Tips and lessons to note during this step.

📖 Resources for reference and further information.

⏩ Next actions to take.

💡Important notes are sidenotes that might bring up key considerations, regardless of the current stage of discussions.

The benefits of mobile network data for statistics

Data from mobile network operators (MNOs) holds immense potential to revolutionize statistics, making them more accurate, timely, and useful. Traditional methods of data collection by National Statistical Offices (NSOs), such as household surveys, census data, and administrative records, are comparatively more costly and time-consuming to produce than the granular data that is generated by mobile phones. It is no wonder that according to the World Bank, 78 percent of NSOs focus on this over any other new data source as a complement to traditional methods of data collection.

The potential benefits of using mobile network data as part of statistics production include:

- Higher overall quality

- Better timeliness

- Better geographical granularity

- New, previously unavailable indicators

- Synergies with other areas of statistics, leading to better coherence and comparability.

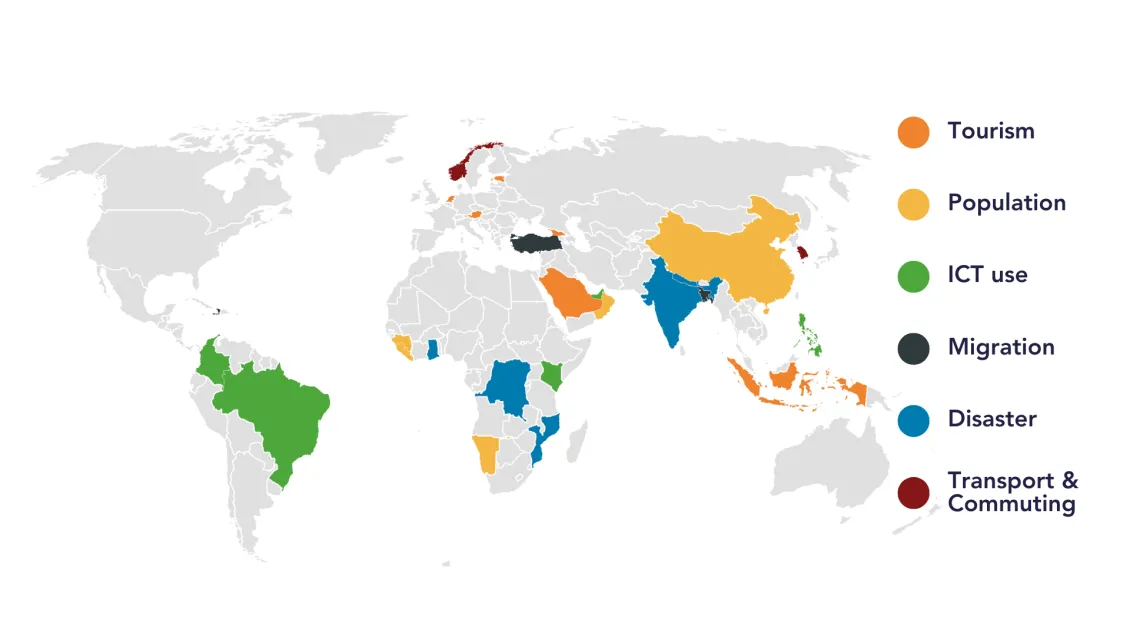

National data systems have already benefited from the use of mobile network data in several domains of official statistics, including: population statistics, dynamics and census; tourism statistics; migration statistics; disaster and displacement statistics; transport and commuting statistics; and measurement of information society.

Yet, for NSOs, challenges to accessing this data come up over and over again creating hurdles that cause projects to stall. Many partnerships take years to plan and launch even as barriers remain consistent across national contexts.

The challenges of accessing mobile network data

Gaining access to privately-held data from mobile networks is often assumed to be a technical issue, but the reality is more complex. Key challenges of accessing privately-held data that statistical offices often encounter include:

- Lack of required skill sets – Technical skills to access, process, integrate and analyze Big Data are often lacking among data sharing partners; for example, most NSO staff do not have the needed skill sets to access and integrate huge datasets. On both sides, partners may lack necessary data science and machine learning skills and experience.

- Limited experience with privately-held data – NSOs are typically focused on data from traditional sources, such as surveys and censuses, and may lack insight into privately-held data, putting them at a disadvantage in technical conversations with mobile network operators.

- Limited experience with the private sector – NSOs are accustomed to working with government and public entities. Engaging with private companies, especially to access sensitive data about their customers, presents a significant learning curve.

- Lack of clarity around incentives and costs – NSOs and mobile network operators often think differently about incentives for partners who are contributing to data sharing. Because costs are associated with such partnerships, all stakeholders need to present ways to cover the costs of the project.

- Limited insight into the statistical system by the private sector – Many private companies are unfamiliar with the role and mandate of NSOs, leading to confusion and delays in starting negotiations. As most data sharing arrangements of this type are driven by NSOs, it’s also on them to address this challenge by providing knowledge and education.

- Outdated legislation – Statistical and telecommunications laws might be unclear or outdated around new opportunities and expanding the scope and reach of the NSO in requesting data from private data holders like operators, requiring all parties to find common ground to proceed.

- Privacy concerns – Very granular mobile network data is sensitive. Discussions between statistical and private sector parties often get stuck on privacy and data protection issues. While both prioritize privacy, they may focus more on their differences than on finding common ground.

- Complex stakeholder engagement – Multiple parties need to be consulted, including citizens, regulators, scientific communities, civil society, and data protection authorities. This can overwhelm organizations already stretched by their regular duties in creating a clear governance mechanism.

Many statistical offices find themselves in a situation where they have identified a data source that has the potential to significantly increase the availability and quality of statistics but are unable to move forward with data access discussions due to the above challenges, even before they enter technical discussions. Understanding these challenges, from the perspective of operators and the NSO, is critical. This guide was written to address the challenges of mobile network data access based on successful examples.

Success stories

There are already many successful cases of countries accessing mobile phone data to produce or improve official statistics.

One useful source for these examples is the UN’s Mobile Phone Data (MPD) Task Team. In 2023-24, the MPD Task Team of the Committee of Experts on Big Data and Data Science in Official Statistics published Methodological Guides that included many successful cases in areas of statistics ranging from tourism to transport. See the 📖 Resources at the end of this section for more information.

The projects in the UN’s MPD Methodological Guides cover:

- 29 percent of the world’s land area

- 50 percent of world’s population

- The world’s biggest (China, India, Indonesia) and smallest (Cabo Verde) countries.

The map below shows the countries in the guide and the domain of statistics that were produced or improved using mobile phone data.

These projects range in maturity and sustainability. Most projects start with some sort of proof of concept to demonstrate the benefits of using a new data source. Depending on factors such as the nature of data access and funding, some projects progress to the next stage, i.e. to a pilot project or to regular, ongoing publication of experimental/complementary data products, and up to using mobile phone data as a primary or secondary data source for official statistics.

The chart below lists countries and existing projects in each, by the level of statistical maturity of those projects, along with the domain of statistics addressed. This roadmap draws on these examples to show how data -sharing partners have managed to successfully navigate steps in mobile network data access discussions.

Countries with mobile network data sharing projects by stage of statistical maturity:

Stage of statistical production maturity | Examples of mobile network data projects |

Proof of concept (PoC) | Some COVID-19 analytics Most volunteer experiments with mobile network operators |

Pilot project | Oman – National Center for Statistics and Information – inbound and domestic tourism, commuting, population France – Central Bank of France – inbound and outbound travel Italy – IStat – inbound and outbound travel Colombia, Brazil, Indonesia, Philippines, United Arab Emirates, Georgia, Kenya – ITU with the NSOs – ICT Statistics The Gambia – Gambia Bureau of Statistics – Migration United Kingdom – Office for National Statistics – population, mobility |

Experimental statistics / Complementary data products | Most COVID-19 analytics Germany – DEStatis – mobility, population Ghana – Ghana Statistical Service – mobility, migration, displacement |

Official statistics: Calibration | Finland – Statistics Finland – inbound/outbound travel Austria – inbound/outbound travel Spain – Domestic tourism |

Official statistics: Main source | Estonia – Central Bank of Estonia – inbound/outbound tourism and travel Indonesia – BPS Statistics Indonesia – inbound/outbound/domestic tourism and travel; commuting Saudi Arabia – Ministry of Tourism – Domestic tourism |

The World Bank’s GDF-MPD program has designed a maturity framework with levels that do not correspond to this chart directly but are a useful way to analyze a country’s level of readiness to publish statistics using mobile network operator data. Find more on the World Bank’s framework here.

Pathways to mobile data access

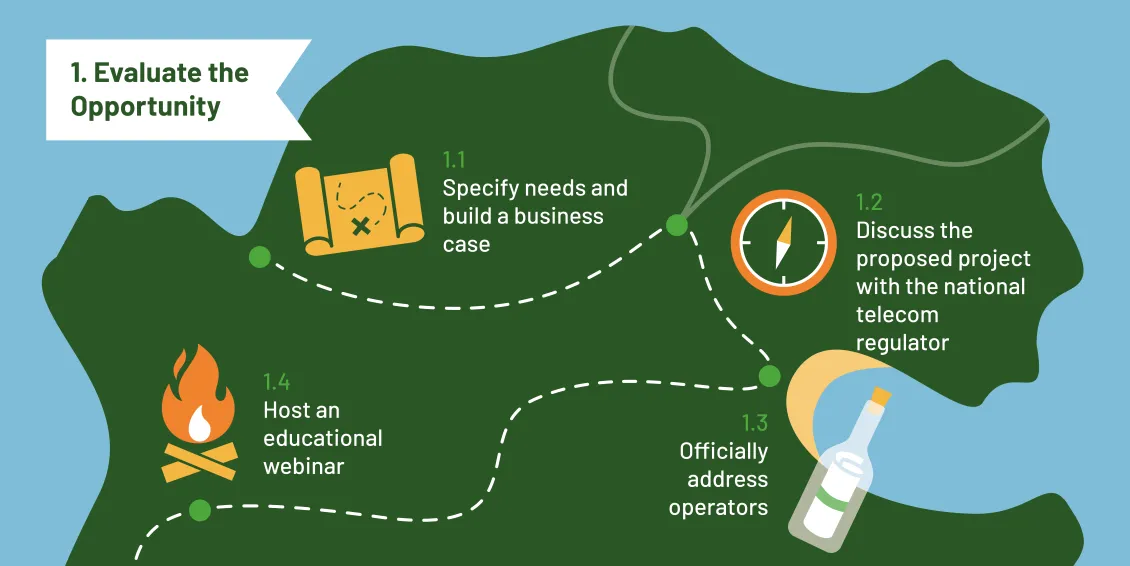

1. Evaluate the opportunity

1.1 Specify needs and build a business case

Official statistics play a pivotal role in informing government policies, and so NSOs are compelled to seek the best source of data for statistics to support evidence-based decision-making.

The request for data from a mobile network operator must be specific, and its benefits must be tangible.

In statistics, specifying needs is the first step to bringing in new data for the statistical business process. This step (1) determines the need for statistical products and statistical needs of national stakeholders, (2) establishes the high-level objectives of the statistical outputs, (3) identifies the relevant concepts and variables for which data are required, (4) checks if current collections and/or methodologies can meet these needs, and (5) prepares the business case to get approval to produce the statistics.

Consider the following questions to address how the new data source would impact statistical production processes:

- Which statistical domain that corresponds to a significant gap in statistics would mobile network data have the largest possible impact on?

- Would accessing mobile network data enable statistical outputs in areas that are currently not covered but are requested by users?

- Do users request data with frequency not currently available via survey data?

- What level of granularity in geography or time is needed but not available via current data sources?

- Would mobile network data complement existing data sources by adding new information or details that would increase the quality of statistics?

- What are the different statistical domains that mobile network data access would impact in the short and long term, both in terms of creating new information and in improving the quality, frequency, or cost efficiency of existing statistics?

Once the answers to these questions are clear, you have a business case for leveraging operator data to support better evidence-based decision-making. At this point, you can move on to the next step and start requesting support.

1.2 Discuss the proposed project with the national telecom regulator

Next in a series of steps to access mobile positioning data (MPD) for statistics, engaging telecommunications regulatory authorities (TRAs or regulators) early can be pivotal. Even though regulators play diverse roles in such projects—they can bridge discussions with operators, guide the regulatory framework, or not be involved at all—a consultation with regulators is an essential step.

Here's how to get started:

1. Identify the role of the national/relevant regulator or TRA.

- The regulator often has regular contact with mobile network operators (MNOs).

- The regulator usually has a development agenda aligning with national goals.

- The regulator may already have the mandate to collect records from mobile network operators.

Refer to 🌐 the examples below to learn more about how the role of the regulator has differed in countries.

2. Establish collaboration.

- Initiate discussions with the regulator to leverage their existing relationships with operators.

- Explore how the regulator can facilitate partnerships and data sharing agreements.

3. Determine a plan of action.

- Establish how existing inter-agency agreements apply to the collaboration or the need for a new agreement between the NSO and regulator.

- Outline the roles and responsibilities of the NSO and regulator.

- Develop a clear plan for reaching out to operators and securing data access.

4. Outline a vision for cooperation.

- The regulator may play one or more roles, which might shift as the project develops. These roles include merely lending support to the idea. Regulators can also facilitate the partnership in the initial phases, up to when regular statistical production is established, or act as the data collecting party, ensuring data is received from the operator and de-identified (to protect privacy) before sharing with the NSO.

1.3 Officially address operators

Mobile network operators (operators) collect data about subscriber activities in their network and are a key stakeholder in the project. Sending an official letter to operator leadership can:

- Establish a formal channel of communication with key decision-makers.

- Assign a dedicated focal point within the operator responsible for data sharing. This person is usually somebody with regulatory or analytical expertise.

- Signal the importance of collaboration in data partnerships.

The contents of the letter should be aimed at leveraging the keys to engagement established in previous steps, namely:

- Explain the rationale for how using mobile phone data helps to achieve national societal impact.

- Indicate existing collaboration with the telecom regulatory authority and, if applicable, support from international organizations.

- List examples of successful mobile network data initiatives in other countries.

- Request to establish communication, assign a focal point, and be prepared to engage in the next steps.

In some cases, NSOs have opted for an indirect approach with operators, through introductory meetings and slowly developing personal contacts. This has led to some success. However, based on feedback from operators in data access projects, what works best is a more direct approach—one where the project’s rationale is well-developed and based on examples from other countries and where support from the regulator and the expectations for operators are clearly explained.

💡 Important note: What is in it for mobile operators?

Engaging private sector partners in a project that requires resources but does not directly generate revenue requires highlighting incentives for their engagement. While regulatory compliance is a key factor (many statistical offices require operators to contribute data), operators may benefit from engaging in data sharing for a variety of reasons.

Here are five key motivations mobile network operators will be able to realize when collaborating on a project for statistics:

- Monetization – Beyond official statistics, explore potential revenue streams from data-driven products and services. By sharing data freely for statistics, operators can discover new use cases—and revenue opportunities.

- Social responsibility – Give back by helping to develop accurate and reliable statistics.

- Capacity building – Build internal expertise and infrastructure for data analysis.

- Reciprocity – Receive data from statistical offices and insights that were not available before.

- Higher quality data products – Join efforts in R&D to add quality and robustness to the operator’s data-driven solutions.

This webinar, hosted by the Global Partnership, features public and private partners from three countries discussing their incentives for engaging in existing data sharing initiatives: Accessing mobile data: National strategies and challenges

Alfian Manullang, VP of Data Solutions and Digital Financial Services at Telkomsel, shared lessons from their eight years of experience providing data to BPS Statistics Indonesia, and the benefits Telkomsel sees from the collaboration.

1.4 Host an educational webinar

How do you ramp up support for your mobile network data project? Several organizations have used webinars to convene and educate the stakeholders for the project, especially operators and users of the statistical products that stand to benefit from the project. (See Glossary for a definition of “users” in this context.) Hosting a webinar—as opposed to an in-person meeting—means you can get something on the schedule quickly, bring in high-level international experts, invite a broad audience, and drum up interest in the project early.

To effectively engage stakeholders and advance MPD initiatives, consider hosting webinars that:

- Educate on the benefits of mobile network data and dispel misconceptions.

- Showcase best practices by highlighting successful MPD projects globally.

- Leverage support from international organizations like the ITU, the World Bank, and several UN organizations who support mobile network data projects for statistics.

Engage stakeholders

2.1 Engage stakeholders through a high-level event and technical workshops

An in-person meeting is the best way to gain high-level support for the mobile network data project as well as discuss data governance issues directly with the stakeholders in an open environment. A combination of a high-level event and technical workshop should be geared towards addressing the challenges of accessing operator data outlined in this roadmap.

These meetings help create clarity around incentives and costs. They should also educate the private sector stakeholders about the role and mandate of the NSO, and the data governance objectives laid out to the NSO in terms of ensuring quality, protecting privacy of data, and utilizing the best data for statistics.

These meetings allow for stakeholder engagement to take place in a transparent setting that fosters discussion. However, this doesn’t mean that these meetings should be publicized widely or open to the public. Raising concerns and addressing barriers to the projects necessitates creating an environment of trust and, often, confidentiality in early stages of discussions.

Engage senior stakeholders with a high-level event

Hold an event on operator data for statistics with key decision-makers from the regulator, the NSO, the national data protection authority, the mobile network operators and key government ministries, helping to build consensus and align expectations to provide broad direction for the project in light of international benchmarks and local stakeholder feedback.

The event should aim to validate the buy-in of decision-makers for use of operator data for statistics. Consider also inviting the users of statistical products in relevant domains who may lend support to the NSO in making a case for data sharing by articulating the benefits of and need for this data.

It is likely that executives at mobile network operators will praise a project initiative that is well prepared and founded on international benchmarks of success. Final decisions are not necessary at this point. Reaching high-level agreement that allows for follow-up technical discussions is important in order to progress to detailed discussions.

Host technical workshops

Technical workshops will encourage in-depth discussion with technical stakeholders. Each major stakeholder should be represented, specifically the managers and senior analytical staff of the operators, the regulator, and the NSO; this meeting should provide ample opportunity for the technical staff to share information with colleagues who may not be familiar with the technical requirements of each organization’s participation in the project.

The objective is to reach a consensus on the technical aspects of the use of MPD for statistical purposes, such as statistical needs, stakeholder motivation, data requirements, data processing modalities, quality criteria, and next steps for project planning.

The workshop discussions should lead to drafting a concept note for the project. See the next step for a full list of topics that make up the concept note. Go through all topics and focus on those that elicit concern or debate.

2.2 Send a detailed project concept note to operators

Based on the steps up to this point, a project concept note can be created with inputs from the workshop. If the discussions have been fruitful and transparent, the main topics to include in the concept note should have been addressed. Importantly, the sections of the concept note should include:

- Background – Describing the mandate and objective of the NSO to start the project.

- Objectives – Purpose of the document.

- Stakeholders and roles – Lead partner (e.g. the NSO), technical partners (e.g. mobile network operator and regulator), accountable partners to be consulted (e.g. offices of data protection and cybersecurity), users, supporting organizations, and any other stakeholders.

- Governance structure – Organization of stakeholders, e.g. into technical and steering committees.

- Specified needs – National statistical and development programs and users to benefit from the project.

- Benefits for users, technical partners, and other stakeholders – Incentives structure proposed to stakeholders in the project.

- Raw data requirements – Description of data requirements, following the principle of data minimization. Data minimization is a principle that limits the amount of personal data that is collected, processed, and stored. It's a key part of data privacy and protection.

- Location of data storage – Description of where the data storage and processing capabilities will be set up.

- Data sharing scenarios – Discussed scenarios for data sharing, including who will become the data controller under each scenario. For more on arrangements related to data sharing, storage, and management, see information presented during this World Bank GDF-MPD event.

- Communication and publication – When and how the project will be communicated to the public, or the means to decide on communication.

- Costs – Costs identified and the potential sources for covering such costs.

- Identified risks in project initiation – Identified risks and mitigation strategies.

- Next steps and timeline – A list of the next steps in the process, who is responsible, and when they should be completed.

This concept note is an important milestone in reaching consensus among major stakeholders, including the regulator and mobile network operators, and should be sent to them as a draft proposal for input. For the operators, the proposal draft should be accompanied by a letter addressed to the CEO that includes:

- The objective of the project

- Data requirements

- Data sharing scenarios

- Proposed immediate next activities.

2.3 Executive meeting between the NSO and mobile network operators

A critical juncture in this process is convening a formal meeting between the heads of the NSO and participating mobile network operators. This high-level meeting, conducted through established formal channels and procedures, serves as a pivotal moment for finalizing the collaboration and moving the project forward.

With the regulator either present or duly informed, the meeting provides a platform to secure executive-level buy-in, address any remaining concerns, and formally establish the governance structures necessary for successful project implementation.

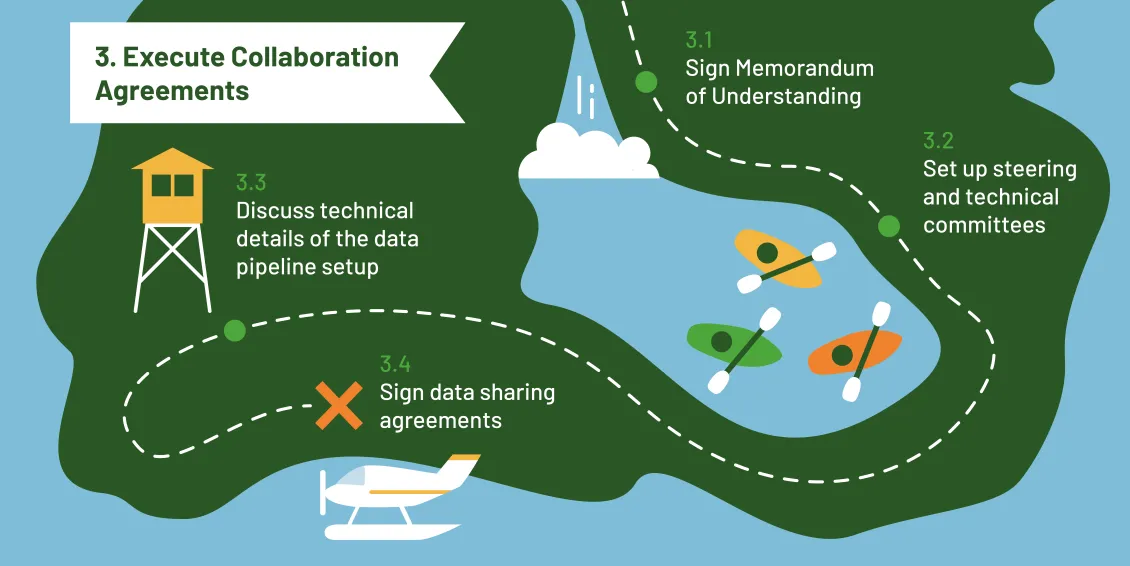

Execute collaboration agreements

3.1 Sign a Memorandum of Understanding

Before delving into the intricacies of a formal data-sharing agreement, it is often good practice to first develop and sign a Memorandum of Understanding (MoU) between the National Statistical Office (NSO) and the mobile network operator. This non-binding agreement serves as a foundational step, outlining the general objective and collaboration principles of the partnership.

The MoU clearly defines the roles and responsibilities of each party, acknowledges the NSO's mandate to access data for statistical purposes, and addresses concerns regarding data security, confidentiality, and technical assistance. While not legally binding, the MoU fosters a conducive environment for open communication and a shared understanding of expectations, paving the way for a more comprehensive data-sharing agreement.

The content of the MoU can vary depending on the specific needs and priorities of the NSO and the operator. However, it typically includes elements such as:

- Purpose of the collaboration – Stating the shared objective of utilizing mobile network data for statistical purposes.

- Roles of parties – Defining the scope of the responsibilities for implementing the MOU of each party.

- Data scope and access – Defining at a high level the types of data to be shared between parties and the level of access granted.

- Confidentiality and data security – Outlining measures to protect the privacy and security of sensitive data.

- Data quality and validation – Establishing procedures for data quality checks and validation.

- Communication and reporting mechanisms – Defining how the parties will set up decision-making structures (a steering and technical committee), communicate and share progress updates.

- Dispute resolution mechanisms – Outlining procedures for resolving any disagreements or disputes.

- Contact persons – Identifying designated points of contact for both parties.

By establishing a clear framework through an MoU, NSOs and the mobile network operators can build a strong foundation for a successful and mutually beneficial data-sharing partnership.

3.2 Set up steering and technical committees

Steering committee

The steering committee should be set up as a designated accountability board, composed of the determined key decision-making (higher management) members of each of the major stakeholder groups. It will be consulted on major developments of the project and will review, advise, and guide the process, making direct inputs to ensure that the benefits of the project to their institutions are successfully achieved. The steering committee will meet more frequently at each new stage of development, as well as at the initiation of the project, and will take a regular supervisory role post-implementation.

Example member organizations of the steering committee include: the National Statistics Office, telecom regulatory authority, mobile network operators, data protection authority, national cybersecurity authority, civil society representative organizations, and academia. Including civil society groups in the steering committee helps reassure people an independent voice is looking out for potential harms to the public from data sharing. In Ghana, for example, the African Digital Rights Hub was brought into the steering committee to mitigate risks related to public trust.

Example level of hierarchy represented: Director Generals, Vice Presidents, Data Protection Commissioner, National Cybersecurity Adviser, department heads.

Technical committee

A technical committee should also be set up, composed of dedicated personnel from the technical partners. The main role of this committee will be to initiate and monitor the technical aspects of the project, such as the methods and processes, as well as the performance of the technical providers. Any ongoing technical blockers will be escalated to the steering committee for action. The technical committee is a subgroup of, and accountable to, the steering committee.

The member organizations of the technical committee are usually the implementing partners of the project, most notably the National Statistics Office, mobile network operator(s), possibly the telecom regulatory authority, and other members, if they have a technical role in the project. Intermediaries, like Flowminder or Positium, may be involved in the project and advise—but not be part of—the technical committee.

Example level of hierarchy represented: Project Managers, Head of Analytics Department, Head of Business Intelligence, and Senior Analysts.

3.3 Discuss technical details of the data pipeline setup

Before finalizing a data sharing agreement, meticulous attention must be paid to the technical aspects of data transfer and processing. This crucial step involves a comprehensive discussion between the NSO and operators to define the parameters of the data pipeline. Key considerations include:

- Data streams and formats: Determining the specific data streams to be shared (e.g., call detail records, signaling data) and the expected file formats (e.g., .csv, Parquet).

- Data storage and retrieval: Defining the data storage location (e.g., NSO servers, operator servers, regulator servers, government cloud), storage format (e.g., structured databases, HDFS), and data retrieval methods (e.g., APIs).

- Data frequency and volume: Establishing the frequency of data delivery and estimating the expected data volumes to ensure adequate storage capacity and processing power.

- Data anonymization and encryption: Agreeing upon the anonymization techniques (e.g., ID hashing, sampling, aggregation) and encryption methods to be employed to safeguard user privacy.

- Data storage policy and business continuity plan: Defining data retention policies, backup procedures, and disaster recovery plans to ensure data integrity and availability.

- Data management policy: Establishing clear procedures for data handling, including data access controls, data quality checks, and data documentation.

- Assigning authorized data processors: Identifying and assigning specific individuals or teams within the NSO or technical providers as authorized data processors, responsible for handling and analyzing the data in accordance with agreed-upon protocols.

3.4 Sign data sharing agreements

Data sharing agreements are crucial for formalizing collaborations between NSOs and mobile network operators. These agreements outline the terms and conditions for data access and use, ensuring that all parties understand their rights and responsibilities.

Key aspects of these agreements include:

- Data ownership: Clearly define the roles of data controller and data processor, and establish clear rules for authorizing and governing data processors handling the shared data.

- Data anonymization and aggregation: The agreement must explicitly detail the level of data anonymization and aggregation required to protect user privacy. This includes specifying which categories of data the NSO can access and how the data will be processed to remove personally identifiable information.

- Data handling: The agreement should clearly define the responsibilities of each party in handling the data. This includes data storage, security, and analysis protocols.

- Data use limitations: The agreement should specify that the operator data can only be used for the stated statistical purposes and prohibit its use for commercial or other unauthorized purposes by the NSO.

- Data deletion: The agreement must outline procedures for the secure deletion or return of data to the mobile network operator upon completion of the project or as per agreed-upon timelines. Usually capped by regulation to two years or less.

- Publishing results: The agreement should address how research findings and publications will be disseminated, including considerations for data privacy, intellectual property rights, and attribution of the data source.

- Compliance with regulations: The agreement must ensure compliance with relevant data protection regulations, such as GDPR. This may involve establishing data processing agreements (DPAs) to further clarify data processing activities and ensure compliance with privacy laws.

Conclusion

As national statistical systems adapt to changing technologies and needs of users, data from phone companies holds the potential to address a broad range of needs for better and more granular data to guide public policy. Pilot projects are beneficial, but they are just the beginning; the benefits of data sharing between operators and statistics offices increase as these projects mature. Fortunately, many countries around the world have established effective pathways for accessing such data, providing a blueprint for others seeking to initiate data access.

However, because many countries with interest in accessing this data are sidelined early in the process by numerous non-technical challenges that arise in the course of organizing a data sharing partnership, this guide is a roadmap to provide assistance at every step to ensure your journey starts off on the right foot. While the fundamental approach will remain the same, specific details may vary from one country to another and the steps in this roadmap can be adapted to meet local needs. The additional resources linked throughout the guide provide more information in greater detail. Finally, international organizations, experts, and experienced National Statistical Offices are well-equipped to provide support at every step of the journey, ensuring that each country can successfully leverage mobile network data to enhance its statistical capabilities.

Authors and acknowledgements

Siim Esko, Positium

Siim is one of the world’s experts on mobile phone data use for statistics. Since 2014, Siim has been working in the data analytics sector at Positium, where he manages the development of international projects in the fields of tourism, mobility, and population statistics based on mobile positioning data.

With his colleagues at Positium, Siim has had a hand in some of the notable projects in the field, including:

In 2014, the launch of the European Commission’s Feasibility Study for the Use of Mobile Positioning Data for Tourism Statistics.

In Oman, since 2016, working with the National Centre for Statistics and Information on their big data pilot project with two mobile network operators.

In Indonesia, since 2017, working with BPS Statistics Indonesia and the Ministry of Tourism to launch regular production of tourism statistics with the largest mobile network operator in Indonesia.

Being a core member of the Mobile Phone Data Task Team at the United Nation’s Committee of Experts on Big Data and Data Science for Official Statistics, and leading the subgroup of population statistics.

In 2023, working with the Global Partnership to conduct an online training course with 18 NSOs on mobile phone data access and use, leading many of the countries to follow up with national projects.

Siim continues to work in the field, and will be part of the training team of the World Bank-ITU Global Data Facility’s Putting Mobile Phone Data to Work for Policy program, as well as assisting countries around the world to gain access to and benefit from the data held by mobile network operators.

Janet McLaren, Policy Manager for Accountable Data Governance at the Global Partnership, contributed to writing and producing this roadmap.

Global Partnership for Sustainable Development Data (Global Partnership)

The Global Partnership is a network of over 700 private sector, academic and civil society organizations, and governments, with a Secretariat based across eight countries. We work across more than 35 countries and convene a network based in over 80 countries. We leverage the power of data to change minds, policies, and lives for the better. Our aim is to ensure that data can be put to good use to achieve the Sustainable Development Goals.

Acknowledgements

Ruby Richardson, Communications Manager at the Global Partnership, oversaw copyediting, design, and publication. This work draws on years of work with countries on data sharing by Global Partnership Secretariat members including Martina Barbero (Policy Manager), Linet Kwamboka (Senior Policy Manager, Data4Now), Fredy Rodriguez (Senior Latin America and the Caribbean Regional Manager), and Victor Ohuruogu (Senior Africa Regional Manager).

We are immensely grateful to Siim Esko and Positium, for their work with us in countries and in producing this report. To a large extent, this publication has been improved thanks to partners who took careful time to give their feedback and input, and so we extend our sincere thanks to those who reviewed and contributed to this publication:

Paul Baptiste Blanchard, Development Economist | World Bank

Erwin W. Knippenberg, Senior Economist, co-leads of the GDF-MPD program | World Bank

Trevor Monroe, Senior Program Manager, GDF-MPD program | World Bank

Potlako C. Kgari, Senior Statistician and MPD Project Manager |Statistics Botswana

Esperanza Magpantay, Senior Statistician | International Telecommunications Union

Titi Kanti Lestari, Director previously in charge of MPD projects in BPS Statistics Indonesia, current consultant and member of the MPD Task Team of the UN Committee of Experts on Big Data and Data Science in Official Statistics.

Cathy Riley, Director of Strategic Partnerships, and Sophie Delaporte, Marketing and Communications Manager | Flowminder

Erki Saluveer, Member of the Board, and Kadri Arrak, Head of Operations | Positium

Federico Segui, Deputy Director-General | Instituto Nacional de Estadísticas de Uruguay

Glossary

DPA = Data protection authority

Operator or MNO = Mobile network operator, (also known as a mobile network provider or carrier, wireless service provider or carrier, cellular or telco company) a company that provides wireless communications services to customers. Mobile network operators own a license to use a swath of the mobile spectrum exclusively, as designated by a regulatory agency (see regulator) and own or control the cellular network infrastructure to provide service.

MPD = Mobile phone data, referring to the positioning data gathered and held by mobile network operators. Also referred to as mobile positioning data or mobile network data or MNO data, inclusive of CDR (call detail records) and signaling data.

NSO = National Statistical Office, a government agency responsible for collecting, analyzing, and disseminating statistical data on a country's economy, population, and society, providing crucial information for policy-making and public understanding.

NSS = National statistical system, a network of government and quasi-government agencies and organizations that coordinate to produce official statistics.

Regulator or TRA = Telecommunications regulatory authority, an independent government body that oversees and regulates the telecommunications industry, issuing licenses and ensuring fair competition among licensed operators (see MNO) and protecting the interests of consumers.

Users = In data science and statistics, end users are the entities that use data or statistical products. In this text, “users” refers to the ministries, departments, and agencies of the government and others who benefit from and can sponsor the production of higher-quality statistical products produced as a result of partnerships that provide access to mobile phone data (see MPD).